The days when people had to queue at banks to get cash to run one financial transaction or another, are long gone. The advent of mobile banking has made the financial system easier. Today, people do not need to fill out a paper form to get their money out of their accounts. Bank customers can withdraw cash from their accounts and make payments with a swipe of their fingers in less than a minute.

Digital banking has brought a whole new era into the financial world, and more people across the globe are embracing it. The download of mobile banking apps with exciting features to cater to customer needs is rising. Through this article, you’ll learn the recent trends in mobile banking and what the future holds for the industry. Let’s dive in.

Key Statistics

General Mobile Banking Statistics

1. Mobile banking is likely to hit $3.3 billion worldwide at the close of 2025.

There has been a steady rise in technology in recent years. The development in the digital ecosystem has outdone the hopes of industry experts. One outstanding development in recent times is artificial intelligence (AI). It has helped to increase business output by 40%. Another area that has grown is the Internet of Things. IoT connections are of great help to the corporate world. Technological progress will most likely affect the expansion of the mobile banking industry.

2. Just 1% of Citi Mobile app users were between 18 and 29 years old as of March 2023.

Protecting the personal data of Users is Citi Mobile’s top priority. It uses methods like biometrics to keep users’ data safe. One exciting feature of this app is that users can access their account summary offline. The Citi Mobile app is designed on the go for customers’ ease.

3. Bank of America serves about 69 million people in the United States.

The United States has around 69 million Bank of America customers, with about 3,800 retail finance centers. ATM clientele has risen in the past years to almost 15,000. The Bank of America has advanced in digital banking, with around 57 million users across its BofA ATMs and Visa offerings. BofA offers high-quality cybersecurity to users to protect their financial records from hackers.

4. Up to 43.5% of all accounts in the United States engage in mobile banking.

More bank customers across the United States use digital banking services. The rate of smartphone bank transactions rose to 43.5% at the close of 2021. Meanwhile, financial mobile transactions stood at 15.1% at the end of 2017.

Mobile Banking Usage Statistics

5. As many as 96% of the Norwegian population have used online banking platforms since 2022.

European bank customers have the largest percentage of online banking usage. Up to 95.84% of people in Norway use Internet banking services. As much as 94.84% of people in Iceland use online banking, while 94.68% of Finland’s population uses online banking. Countries with the lowest mobile banking rates in 2022 were Herzegovina and Bosnia, with 12.82%. Montenegro fared low with 11.35% usage, and Albania at 5.24% patronage.

6. Just 24% of Britons in 2023 had switched to the use of only digital bank accounts.

In 2023, about 12.6 million Britons used only a digital account, representing 24% of the total number of account holders that same year. At the close of 2023, about 5.3 million Britons were likely to transition from traditional to digital banking. This meant just 10% of bank customers used only digital banking services. Meanwhile, the number of digital account holders was 9% as of 2019, and it will likely rise to 42% by the end of 2028.

7. Mobile banking is used by 71% of people in developing countries.

The COVID-19 pandemic heightened the use of mobile banking services. People could not freely move around and were wary of physical contact. Physical money has been considered unclean, limiting the use of cash during the pandemic. This scenario helped to increase mobile banking usage. Only 42% of people in poor countries a decade ago operated a mobile bank account. The number has increased in recent times to 71%. Just 51% of the global front had a mobile account ten years ago, but the status quo has changed today to 76% of adults.

Mobile Banking Demographics

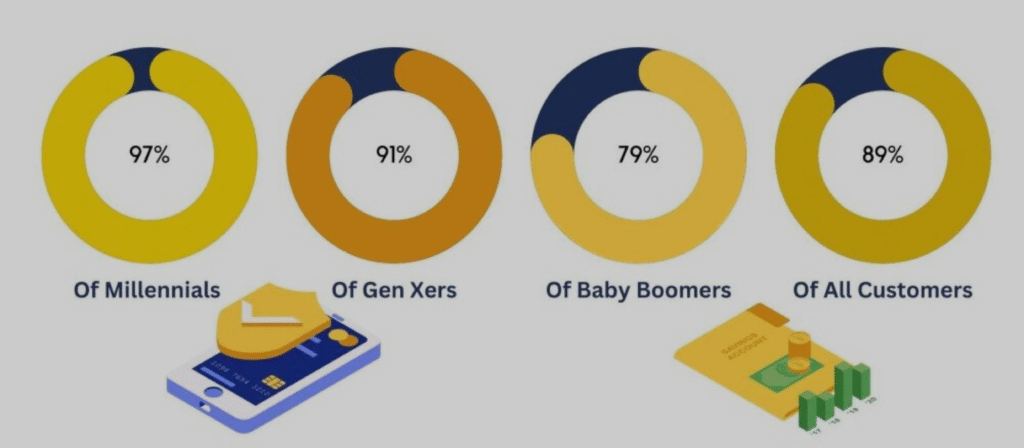

Bank customers and online users are getting more relaxed with digital banking. Customers who use their mobile phones to access their bank account have risen to 80%, meaning about 169.3 million Americans practice mobile banking.

8. Mobile banking is the first call of choice for 52.3% of multicultural households.

Only 45% of black households and 41% of whites use mobile banking services. Only 25.7% of Asian families use mobile apps when banking. Meanwhile, 52.3% of multiracial families make use of mobile banking. Thus, most users of mobile banking services are multiracial families.

9. Just 15.3% of folks aged 65 years and above use mobile banking

The young generation is more excited about the new wave of online digital banking. Meanwhile, a few older adults also use their smartphones to access their accounts. FDIC research in 2021 found that more than three-quarters of customers from 15 to 24 use mobile banking. This group of customers prefers mobile banking over traditional methods.

10. As many as 5.44 billion people across the world have a mobile device.

Mobile devices are fast becoming a part of our daily lives. An average person presses a smartphone 63 times in a single day. Part of the time spent using a smart device is on a bank app. The world has 5.44 billion mobile users, which will likely see a 29% increase by 2027.

Recent Trends in Mobile Banking

11. The rate of bank payments through voice notes rose by 95% in just 2022.

Bank mobile app voice service allows customers to make payments by sending a voice note. It is fast becoming a norm in several bank apps. Mobile bank app transactions worth $2 billion were made in 2018 through voice notes. This rose to reach $40 billion (95%) at the close of 2022. The use of voice commands is more familiar to the younger generation. Most of the time, a smart speaker is used to make a voice command. 118 million people in the United States use these smart speakers.

12. The United States had 6.7 million Apple mobile account users in early 2022.

In 2019, Apple launched the Apple savings account card. Apple smartphone owners can use the card to access banking services. You get an interest rate of 4.15% with the Apple Card. This is higher than what is obtainable at traditional banks. The United States Apple Card users rose to 6.7 million in just 2022. Millennials make up 70% of the total number of its users. This is simply because of their love for the fast life and technology.

13. As many as 72% of people use facial recognition to open their mobile apps.

Password verification is becoming more popular every day. It is a cybersecurity measure that captured the banking world. Passwords in letters, numbers, and symbols can be easily decoded. You need personal biometrics to secure your account. Banking apps are now making use of passwordless verification methods. Up to 72% of people use facial recognition to protect their bank accounts.

Additional Mobile Banking Statistics

14. Up to 73% of students in 2020 used mobile payments to pay their fees.

As high as 67% of college students tested the reality of making mobile payments. They also tested the ability to make payments through the college app. Only 23% of uni students successfully made purchases with their school app.

15. Digital cryptocurrency banking worldwide has grown to 23% usage.

As of 2021, just 18% of people in the United States and 17% of residents in Europe had crypto assets. The global crypto market’s value was around $3 trillion at the time. Digital currency is used in African countries like South Africa (7.1%) and Kenya (8.5%).

16. Over 150 million folks in 42 nations of the world use Google Pay

Google Pay is an online payment system that is getting popular among folks. It tends to replace the old system of banking. Google created this payment system to ease clients. About 800,000 businesses have adopted Google Pay as a trusted payment option. Meanwhile, just 20% of online buyers use it to make payments. Google Pay can favorably compete with other online wallets like Samsung Pay and Apple Pay. Everyone has their preference regarding a mobile payment vendor. Samsung Pay and Google Pay are the most used as they are available in almost all countries. Meanwhile, Apple Pay cannot be used in all places.

17. Cardless banking rose to hit 48.1% at the end of 2020.

The rise in the number of card thefts brought in the need to introduce a cardless banking system. This is a system in which you do not need a card to get cash out of an ATM. There were security concerns about the use of bank cards from a public ATM standpoint. The Bank of America provided service machines to combat the rising issues. The bank took a step forward by frequently working on the security of the devices. More innovations are happening in the cardless banking system. It is becoming more acceptable in all countries of the world.

18. Apple Pay was used by 25% of college students as of 2022

The use of Apple Wallet as a choice digital wallet has grown over the years by 56%. The fast growth shows that the Apple ecosystem is gaining strength. Google Play has not been left out of the growth loop, rising from 6% to 12% in a year. Young people find it easier to navigate the many digital payment methods. This statistic shows that mobile payment appeals most to the younger generation.

Conclusion

The banking system has evolved over the years from traditional to digital methods, allowing people to perform transactions on the go from anywhere. This new method of banking is fast becoming a trend in many countries of the world. The COVID-19 pandemic introduced the needed push, making people see the need to adopt mobile banking methods. The fun part of mobile banking payment is that it takes a few seconds to complete a transaction. Schools across the globe are fast adopting mobile payment as the norm for fee payments. Some schools have apps through which students can make payments with ease.

Mobile banking is more common among millennials and the Gen Z generation. They love the fast lane and opt for online payment over traditional methods. The development of cashless payments and digital wallets like Samsung Pay and Google Pay is just the tip of the iceberg. We have yet to see the latest developments in mobile banking.

Frequently Asked Questions

The use of mobile phones is growing, especially among the younger generation. It is a form of Internet banking that saves users time and effort.

Considering the advancements in AI for real-time and mobile banking services, 2025 promises to be an exciting year. Bank customers should also expect personalization of services across all mobile channels.

Mobile wallets allow you to access funds in your account. Examples of wallets in use include Apple Pay, Samsung Pay, and Google Pay. You can transfer money and pay bills with a digital wallet. A mobile bank, on the other hand, manages your funds.

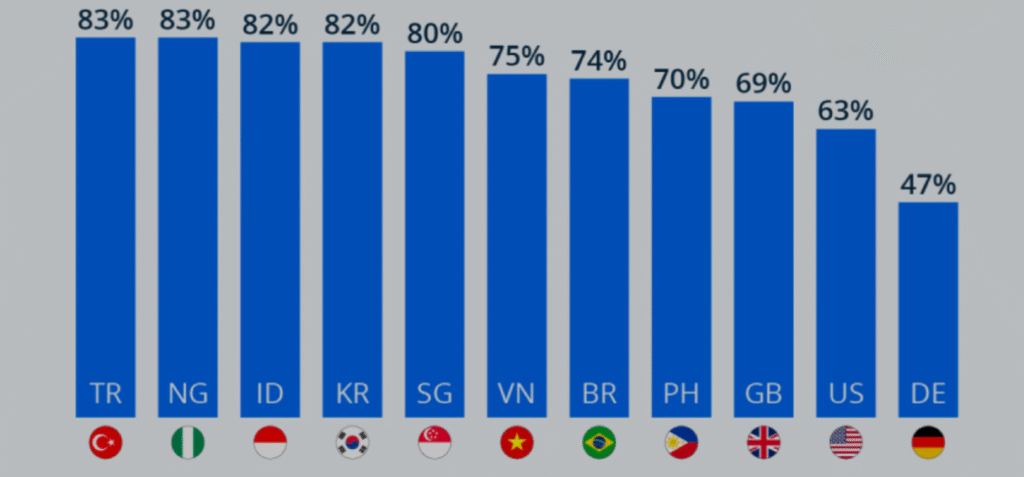

South Korea, with 82% each, had the highest percentage of mobile bank users in 2023. The most common devices used for transactions in Korea were smartphones.

Yes, there sure is! Blockchain technology is a hitch in the world of banking. It carries out cross-border payments and identity authentication.