The number of students turning to loan sharks, banks, and the government to borrow money for their studies keeps increasing yearly. Paying college fees in most countries, especially in the United States, is challenging for many students, leading to debt for students and parents. The average student graduates from college with a backlog of debts waiting to be paid later. Still, more people flood into schools, many taking loans to fund their education. This is due to the belief that an educated person can afford a better life.

Low interest on federal student loans and flexible payment options attract more borrowers. With the high value and emphasis placed on education, taking loans for school won’t end soon. It’s a trend that will likely boom even more in the future. This article explores fascinating facts about student loan debt with statistical data revealing some surprising things you probably didn’t know about college loans. Let’s dive in.

Key Statistics

General Statistics

1. American Students in the Third Quarter of 2023 Owed As Much As $1.74 Trillion.

The amount of education debt owed by students in the United States rose to $1.74 trillion in the third quarter of 2023. This increase in student loan debt remains a cause of concern to the state and experts alike.

2. As Many as 93% of Debtors Took Loans to Settle Their Educational Fees.

Up to 93% of students pay their way through school with loans, and as many as 81% of parents enter into debt to pay their wards through college.

3. Seventy – Five Percent of Debtors Had to Take a Loan For a Two—to Four-Year College Course.

75% of students who owe debt attended a two-year —to four-year college program. Another 25% had to borrow money to fund their graduate education.

4. 52% of People Who Went For a Loan Felt That It Was Not Worth It.

Having a college degree presents opportunities for a better life. Over half (52%) of persons between 33 years and 40 believe that the student loans they took weren’t worth it. If they could turn back the hands of time, these people wouldn’t have taken a student loan. Up to 32% of older millennials have been able to offset their student loans. This is not the case for the larger group (68%) who have yet to pay off their loans.

5. The United States Presidency Wrote Off Student Debt Worth $1.2 Billion.

The president of the United States approved canceling student debts worth $1.2 billion. About 153,000 debtors on the SAVE repayment plan benefitted from this loan forgiveness by President Biden affected.

Average Student Loan Debt

6. The Average Student Loan Debt At the Close of 2023 Stood At About $37,090.

At the close of 2023, federal loans stood at about $37,090. The debts of 43.2 million people totaled $1.6 trillion.

7. An Average Law Student Owes $130,000 By the End of Their Studies.

A student will most likely have a loan debt of $130,000 at the end of a law program.

8. Up to 54% of Graduates in 2020 and 2021 Fell into Student Loan Debt.

Students who studied for four years in either a private or public school in 2020 and 2021 graduated with an average education debt of $29,100.

9. Students in Business School Owe An Average of $66,300, Law With $145,000, and Medical School With $201,490.

Business school students have the lowest average loan debt of $66,300. This is followed by law school (145,000) and medical students, with an average of $201,490.

10. A Federal Student Loan in the United States Stands At An Average of $37,088.

Many students have an average federal loan debt of $37,088, slightly lower than the private loan debt of $39,981.

11. Just 6% of Students Are Likely to Borrow Over $100,000 in One Year.

A small fraction of students will likely borrow $100,000 to support their educational pursuits.

12. Maryland Leads in the United States With $43,116 Loan Debt Per Debtor.

Maryland is the leader in student loan debts with $43,116, Georgia is second with $41,775, and Virginia is third with $39,599. Florida is fourth with $38,683, while South Carolina is fifth with an average of $38,360.

Federal Versus Private Student Debt Loan

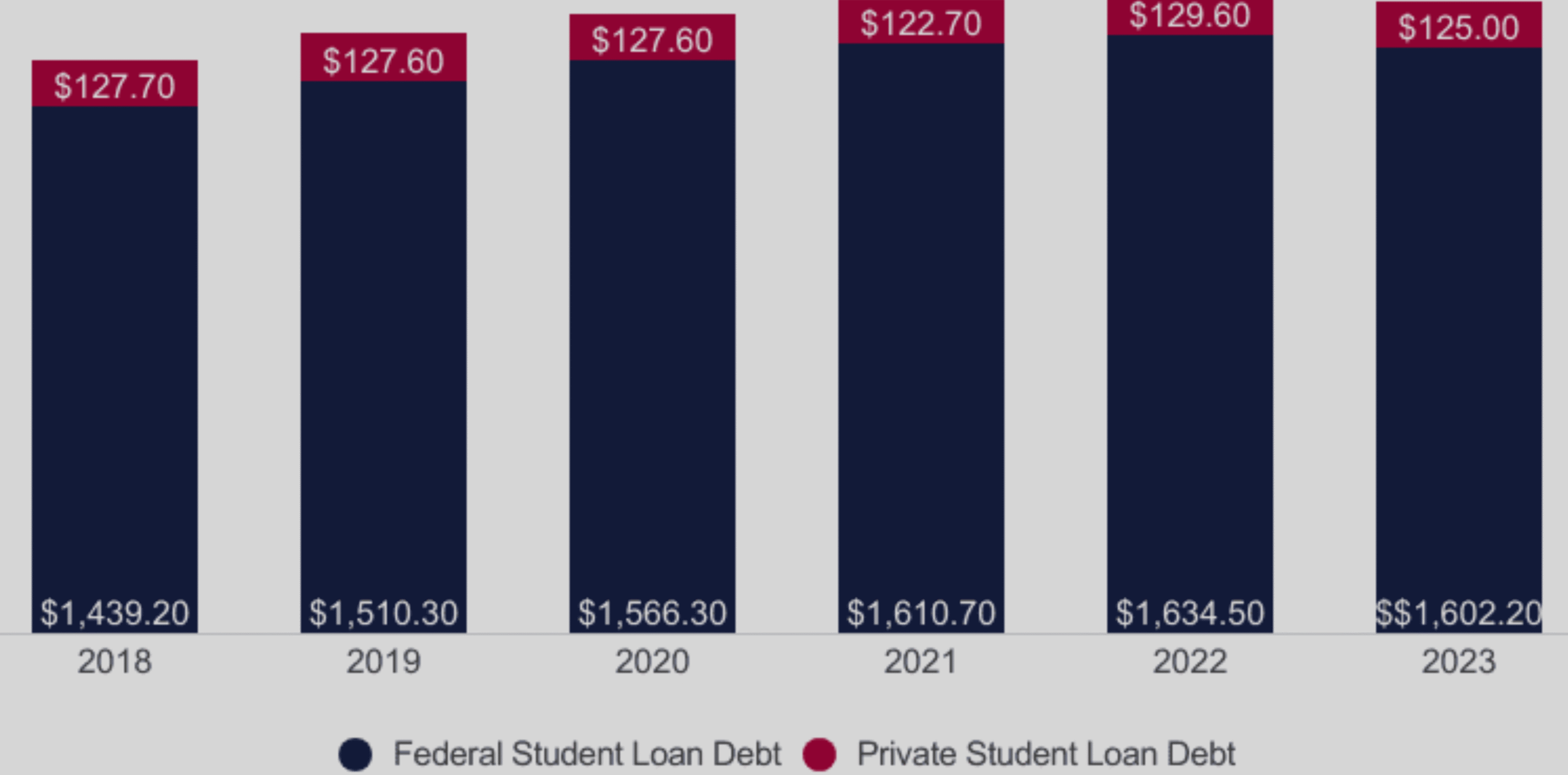

13. A Startling $1.73 Trillion in Student Loans Was Owed By Americans in 2021.

The size of student loans grew by 3% from the past year to hit $1.73 trillion in 2021, even with the write-off of federal student loans worth billions of dollars.

14. 30% of All Student Loans Come From the Federal Government Purse.

Up to 30% of loans come from the federal government purse. Loans with low interest to help students on a four-year course make up 52% of those loans.

15. Private Loans Made Up 8.4% of Student Loan Debt in Just 2022.

Up to 8.4% of educational loans in 2022 were from private sources.

16. Student Loans From Private Borrowers Made Up Just 7.2% of Total Debts In 2023.

Just a tiny fraction of student loans are from private sources. This is simply because their repayment plans are less flexible than the government’s. Just 7.2% of all student loans came from private borrowers in 2023.

Student Loan Debt Demographics

17. One Out of Every Four Persons On A Student Loan Has An Outstanding Credit Card Debt.

Little wonder why the number of credit card debtors is on the rise. Quite a number of them are students who are also on an educational loan. One in every four on a student loan is also a credit card debtor.

18. 54.1% of Students Who Cater For Their Education Collect Loans From the Federation.

Students who fund their education will most likely take advantage of federal loans. As high as 54.1% of students training themselves through college use federal loans.

19. Up to 58.4% of Students in Middle-Class Society Take Advantage of Federal Student Loans.

Students who are not so buoyant turn to federal student loans. As large as 58.4% of those in the middle-class society group are indebted to the federal government.

20. Undergraduate Female Students Take on 41% of All Student Loan Debts

The feminine gender is more likely to turn to student loans. Female undergraduates have a takeout of 41% of student loans, while males have a slice of 35%.

21. Borrowers Between 35 and 49 Have the Largest Outstanding Student Debts.

Those in their mid-years of 35 to 49 have the most significant outstanding student debt, with $491.4 billion.

22. Just 40% of Male Folks Have Student Loan Debt.

Men have a slightly lower percentage of student loan debt than women, meaning women take out loans for school fees more than their male counterparts.

Additional Loan Debt Demographics

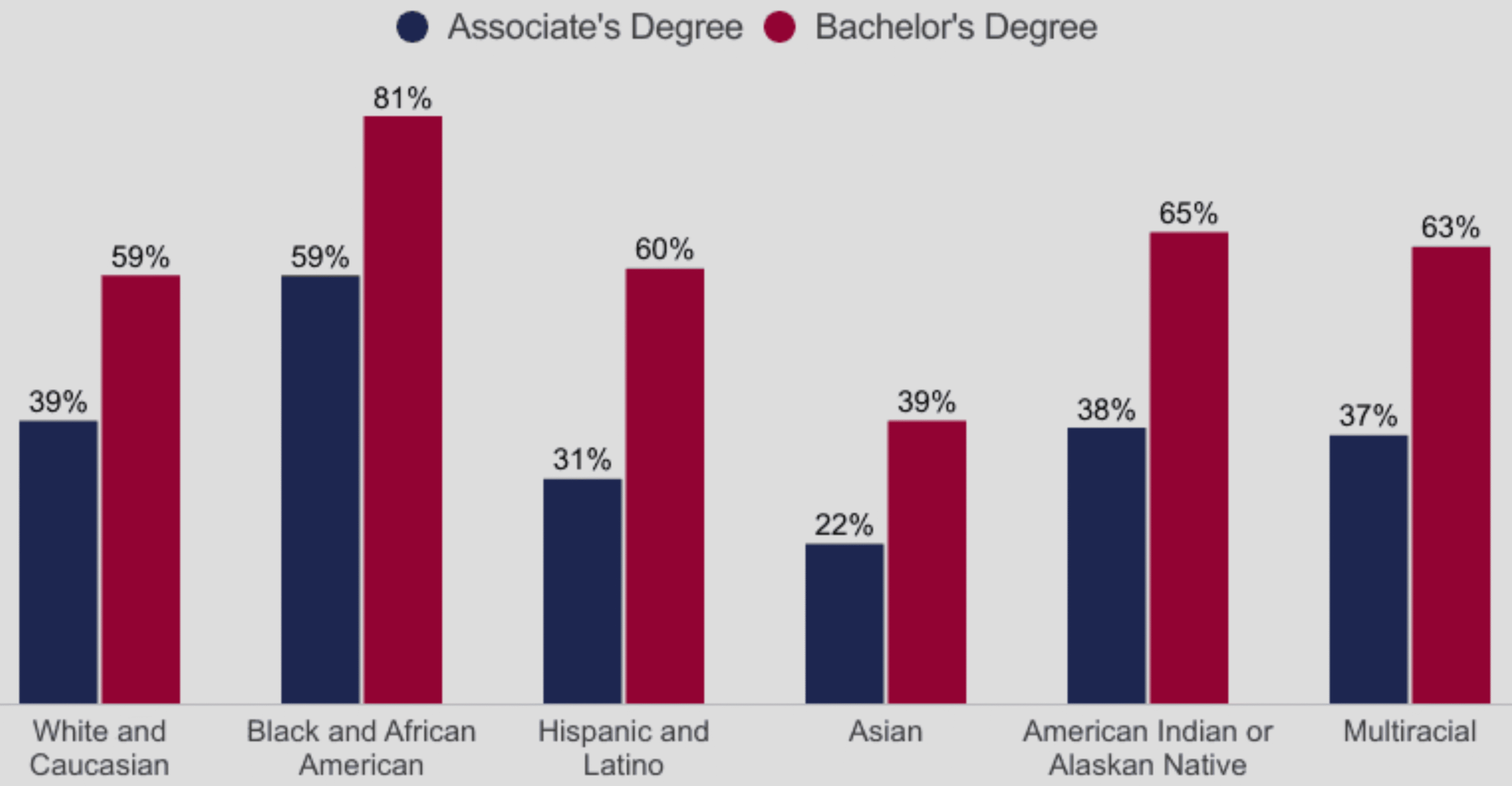

23. Half of Black Adults Have, At Some Point, Taken on a Student Loan

The average black adult owes $9,800 as a student loan. Blacks have the highest percentile of student loan borrowers, with 50%. The Whites come second, with 44% of adults paying a student loan. The average balance of white loan debtors stands at $8,700. Hispanic and Latinos are the least student loan debtors, with an average of just $7,000 by 37% of them.

24. Households With Student Loan Debts in 2013 Stood At 42.1%.

In just 3013, young households with student loan debts were 42.1 %. This was disturbing at the time as it rose more than the credit card debt of 40.1%.

25. The Share of Student Debt in Partnered Households Rose to 50% By 2016.

The number of people taking on student loans skyrocketed from 10% to 50% at the close of 2016. This was slower in single households, as it rose to 45% at the end of 2016.

Student Loan Debt During the Covid-19 Pandemic

26. Student Loan Repayment Decreased by 82% in the Second and Third Quarters of 2020.

There was a fall in student loan repayments all through the second and third quarters of 2020 by 82%.

27. More than 35 Million Students Were Recipients of the CARES Act.

The Coronavirus Air, Relief and Economic Security (CARES) Act introduced by the US government has to its credit 35 million recipients. As a result, there was a fall in the number of loan repayments during the pandemic.

28. The Number of Student Loans Fell in 2020 By 1.79%.

There was a fall of 1.79% in applications for student loans in 2020 due to the pandemic.

29. As Much as 48.8% of Student Loan Debtors Are on a Loan Forbearance.

A good number (48.8%) of people have either stopped paying back their student loans or had their payments reduced for months.

30. 31% of Persons Attending Private Institutions Lagged in Their 2020 Loan Repayments

More persons (31%) slopped in their 2020 student loan repayment. Just 9% of public schools fell into loan defaulting that same year.

Conclusion

Not everyone can afford to go through school without running into debt. Many people would not have completed their course without the help of student loans. Private institutions like banks and several credit houses provide loans to students. The federal government also helps in this regard with lower interest. These debts can sometimes run into years, and some debtors wish they never collected a student loan. In countries like the United States, the government has been gracious enough to write off some student loan debts for citizens.

While it’s hard to say if student loans are worth the investment, the number of people taking them keeps increasing, with little or nothing done to squash it. The statistics in this article show startling facts about student loan debts, showing they will keep rising unless drastic measures are taken to arrest them.

FAQs

The United States has the most significant student loan debts in the world.

Just 45% of students have the honor of graduating from school debt-free. This shows that more students go into debt to pay for school.

Student debt has been on the increase in the last couple of years. As of 2023, it had reached $1.74 trillion.

People between 39 and 49 years of age have the highest outstanding debt in the US. Their student loan debts total $491.4 billion.

Repaying student loans takes an average of 5 to 20 years. Most people will likely repay their bachelor’s degree student loans in 10 years.