Since its birth in 1991, Broadcom has been excellent at developing semiconductor software solutions and infrastructure. From the smartphones in our pockets to the data centers powering the cloud, semiconductors are the beating heart of modern innovation. With the growing popularity of semiconductor solutions for AI and IT, firms like Broadcom are now continually in the spotlight.

These 20+ insightful statistics will equip you with a comprehensive understanding of Broadcom’s impact across various industries with innovative software solutions. These stats and facts show how Broadcom innovations shape the future tech industry. So, whether you’re into investing, tech, or simply curious, this article is your gateway to unveiling the captivating world of Broadcom.

Key Statistics and Facts

Broadcom General Statistics

1. Meta Platforms Inc. is Broadcom’s latest big customer.

2. In 2024, more than 10,436 companies worldwide began using Broadcom as their IT asset management tool. This shows that Broadcom’s tools are trusted and effective.

3. In 2024, more than 373 companies began using Broadcom CA as their infrastructure management tool.

4. Broadcom has established arrangements with tech titans Microsoft and Google, further cementing its presence and influence in the semiconductor market. These partnerships signify the importance of Broadcom’s technology in powering the products and services of two of the world’s most prominent technology companies.

Broadcom Revenue Statistics

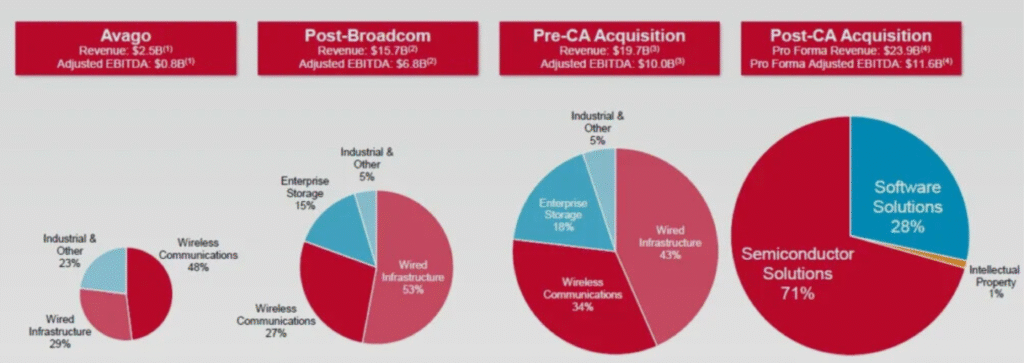

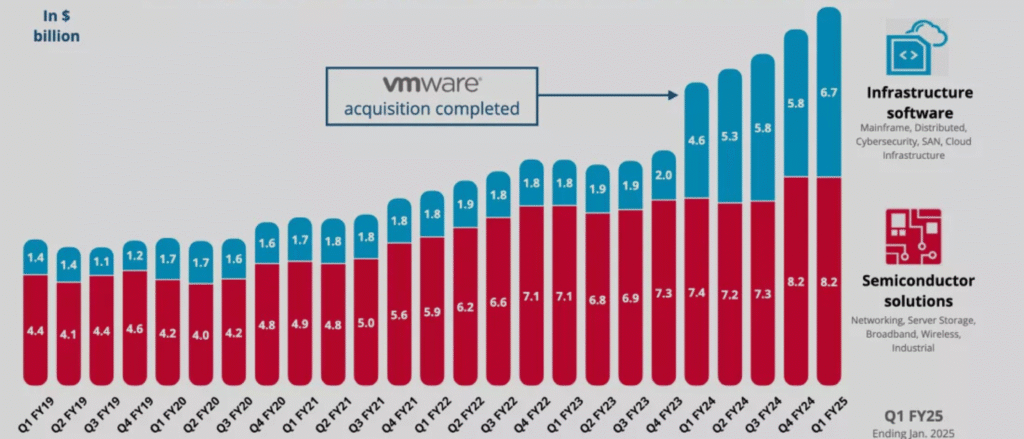

5. As of 2021, a significant percentage (about 73 percent) of Broadcom’s revenue came from its semiconductor products. Its infrastructure software unit accounted for 21 percent of the company’s revenue.

6. In the 2021 fiscal year, Broadcom saw a revenue of $27.45 million globally, a mild increase from the $23.89 million recorded the year before.

7. The company’s semiconductor unit generated approximately $20.38 million in the 2021 fiscal year, and its infrastructure software segment generated $7.07 million in the same year.

8. By country, China accounts for Broadcom’s most significant revenue. As of 2021, the company got $9.75 million in revenue from China and $5.290 million from the US. This was a substantial increase from the $7.81 million and $4.78 million recorded from China and the US, respectively, in 2020. Other countries accounted for $9.66 million in revenue, a notable decline from the $11.3 million recorded in 2020.

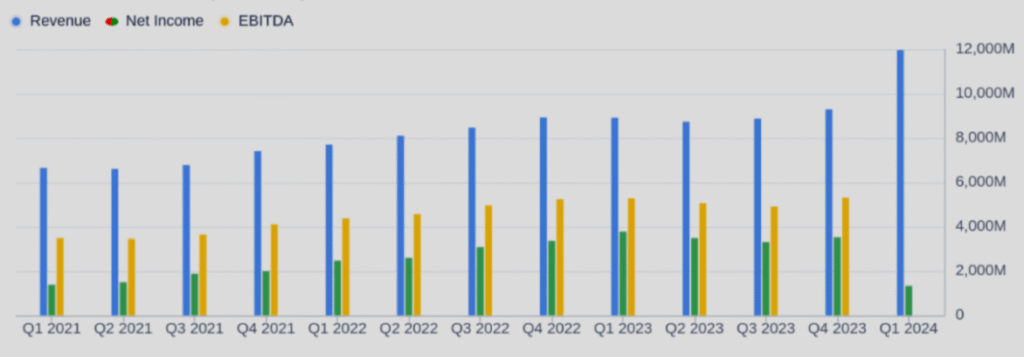

9. As of 2023, Broadcom’s revenue was $35.82 billion, more than $2 billion higher than the $33.2 billion recorded in the previous year.

10. Its operating revenue was $16.21 billion as of 2023.

11. In 2023, Broadcom had about $72.86 billion in total assets, less than the $75.93 billion it had in 2020. It boasted a whopping $23.99 billion in equity during the same period.

Broadcom Employee Statistics

12. More than 1/3 of the company’s 7,200 workers are engineers. Engineers are crucial in designing, developing, and maintaining the company’s products and technologies.

13. Broadcom has more than 600 Ph.D. holders in its workforce, demonstrating its commitment to innovation and expertise in various areas.

14. In 2020, Broadcom employed 19,000 people across its various offices and locations worldwide.

15. As of 2023, the company had as many as 20,000 employees, meaning it has hired an additional 1000 workers from the previous year.

16. At Broadcom, 82 out of every 100 workers are men, while 28 are women. This means there are more male employees than female ones.

17. As much as 72% of Broadcom employees are male, while the female folks make up only 28%.

18. Broadcom’s workforce is mainly white, with 40% white.

19. Asians comprise only 30% of Broadcom employees; Hispanics and Latinos comprise 16%.

20. The minority ethnicity makes up 59.7% of Broadcom’s workforce.

21. Broadcom’s workers remain in the company for an average of 5.1 years.

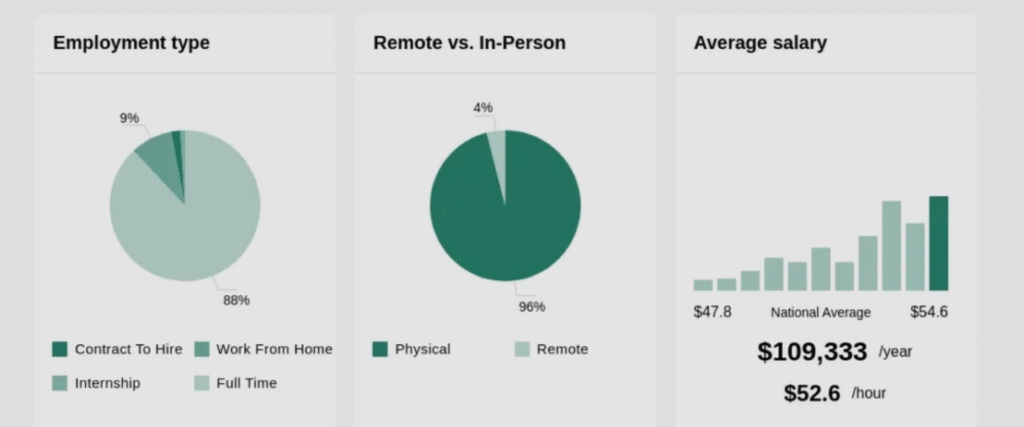

22. The workers at Broadcom fair well to a great extent, earning $121,218 annually on average.

Broadcom Customer Statistics and Facts

23. Broadcom offers support services to its customers, including upgrades, updates, and telephone assistance. These services aim to enhance customers’ experience with Broadcom products and address any issues they may encounter.

24. Broadcom makes most of its money from the royalties and fees paid by software users and professional services.

25. Broadcom also renders customer education services, consultation, and training, besides producing semiconductor software solutions.

Other Broadcom Statistics and Facts

26. Broadcom prioritizes innovation and product enhancement, investing heavily in research and development (R&D). As of 2023, Broadcom invested around $5.25 billion in R&D, more than the $4.92 billion spent the previous year.

27. At the start of 2022, the value of Broadcom’s stock plummeted significantly. The company’s stock closed at $511.54 on January 27, a 30% decline from its December 31 closing price of $665.41.

28. Broadcom’s regular shares are listed on NASDAQ under a ticker symbol. It’s like a code that helps people quickly find and trade Broadcom’s stock on the stock market. Listing on NASDAQ makes it easy for investors to buy and sell Broadcom’s stock.

29. As of October 2023, Broadcom recorded a profit margin of 29.93%, with a net income TTM of $11.58 billion. Its YoY quarterly earnings growth was approximately 172.70%.

30. Broadcom ended January 2024 with a market capitalization of $552.41 billion, a 111% increase from the $261.2 billion recorded at the end of April 2023.

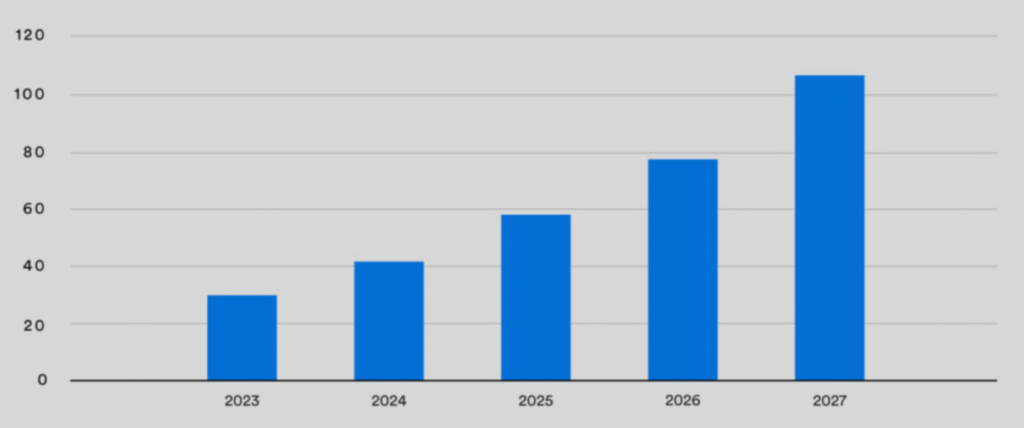

31. Companies like Broadcom are at the center of the ongoing proliferation of AI, 5G, and the Internet of Things (IoT), consistently smashing records in revenue and market valuations. According to data, Broadcom’s market valuation has been increasing steadily; from $261.20 billion in April 2023, it climbed to $594.52 billion as of April 18, 2024.

32. Broadcom has spread its tentacles across many countries, including Europe, Asia, America, and the Middle East (Israel).

33. In January 2024, the global sales of semiconductor chips increased by 15.2% year over year, reaching a total of $41.3 billion.

Broadcom Partnerships and Acquisitions Statistics

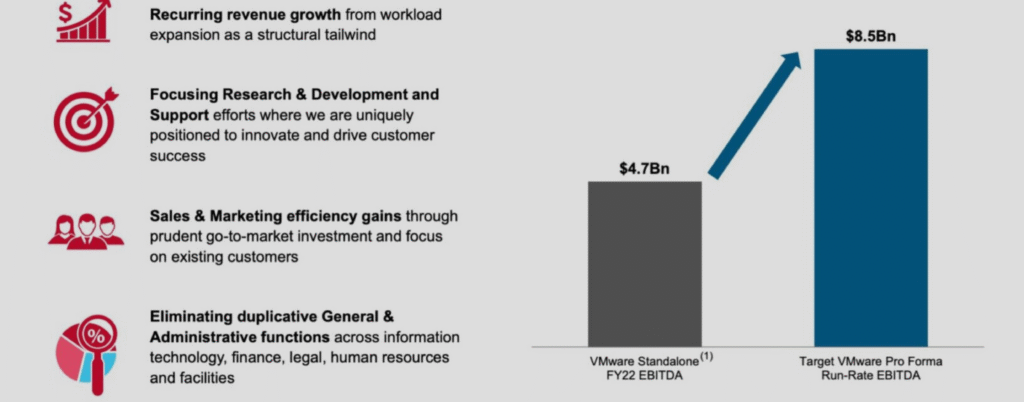

34. In May 2022, Broadcom purchased VMware Inc., a cloud service company, for $61 billion.

35. The company has collaborated with many tech behemoths, including Google. In April 2021, Broadcom partnered with Google Cloud to promote digital transformation within its enterprise.

36. In January 2020, Broadcom also acquired Symantec’s cybersecurity services unit.

37. Nokia Corporation and Broadcom agreed in June 2020 to manufacture custom-made 5G semiconductor sets.

38. In January 2020, it partnered with Apple Incorporated to produce module supplies and wireless components for the tech giant.

39. Again, the firm partnered with AT&T and Palo Alto Networks to design and produce the Disaggregated Scalable Firewall.

40. In December 2021, Broadcom acquired a network performance monitor solution tagged AppNeta.

41. In 2017, Broadcom proposed to acquire Qualcomm for $130 billion, but the company’s board refused.

42. Broadcom was offering enterprise software as of 2022. In June 2018, the company announced plans to acquire CA Technologies enterprise software for $18.9 billion.

43. Moreover, Broadcom boasts ownership of more than 5,000 patents, both in the United States and internationally. These patents represent the company’s intellectual property and innovative solutions.

Broadcom vs. Qualcomm Statistics

44. At Broadcom, employees feel their workplace values diversity more than Qualcomm’s. Broadcom employees give their diversity score as 70 out of 100, while at Qualcomm, it’s 66 out of 100. This suggests Broadcom may promote more equal opportunities and representation across different backgrounds and demographics than most companies.

45. When evaluating the overall corporate culture, Qualcomm emerges ahead of Broadcom based on employee ratings. Qualcomm received a 71 out of 100 culture score from its workers, while Broadcom received 67. This higher rating suggests that employees view Qualcomm’s workplace environment, values, and experience positively.

46. Broadcom and Qualcomm have had legal battles in US federal courts over patent issues. Around 2008, the technology giants engaged in an ongoing legal battle over patent disputes.

Conclusion

Broadcom’s more than three decades of experience have made it a key player in the semiconductor and infrastructure software industry. Besides its number of years in business, Broadcom has been committed to excellence; its resilience and relevance, even in the rough market tides and fast-paced industry, is a testament to this. With constant advancements in AI, IT, and IoT driving demand for semiconductors and infrastructure software, Broadcom will likely see more growth in the coming years. These remarkable statistics reveal the company’s stance in the chips market, intricate operations, and possible growth trajectory over the years.

FAQs

In the third quarter of 2021, Broadcom’s infrastructure software solutions generated 26% of the company’s total revenue. This figure demonstrates the growing importance of Broadcom’s software offerings in areas like data center management, virtualization, and cybersecurity.

The average yearly wage for a Broadcom employee is $125,140. This impressive figure suggests Broadcom prioritizes attracting and retaining top talent in the competitive tech industry.

Apple accounts for a significant 20% of Broadcom’s total sales. As one of the world’s largest tech companies, Apple is an essential customer of Broadcom’s semiconductor chips and components used in iPhones, iPads, and other devices.

As of 2021, Broadcom’s semiconductor unit, its flagship product, generated about 73% of its sales revenue. In the 2021 fiscal year, it made $20.38 million from semiconductors globally.

Broadcom invested a staggering $4.9 billion into research and development initiatives in its most recent fiscal year. This massive R&D budget underscores Broadcom’s commitment to continuous innovation and maintaining its technological edge.